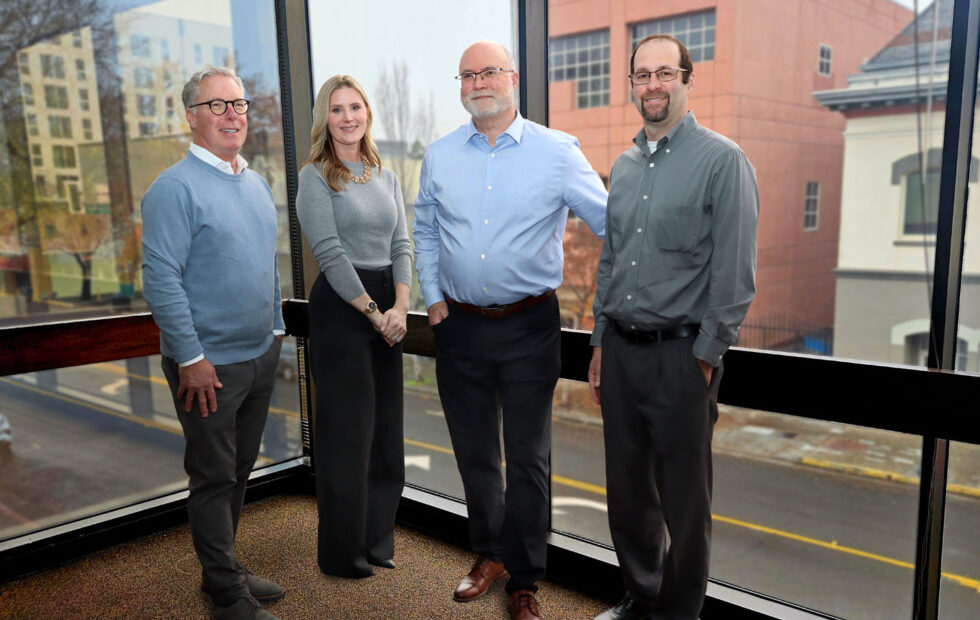

From left to right: Bill Ryan, VP, Investment Officer

Emily Menjou, VP, Personal Trust Fiduciary Manager

John Mackey, SVP, Managing Director of Investment & Fiduciary Services

Matt Kelman, VP, Institutional Trust Fiduciary Manager

From left to right: Bill Ryan, VP, Investment Officer

Emily Menjou, VP, Personal Trust Fiduciary Manager

John Mackey, SVP, Managing Director of Investment & Fiduciary Services

Matt Kelman, VP, Institutional Trust Fiduciary Manager

Trust & Investment

Investment Management

Contact us to get started

Balancing risk and reward

At Exchange Bank, we believe in using proven investment strategies to provide optimal results. Our approach is based on three key principles: asset allocation, diversification, and utilizing low-cost investment vehicles. We carefully balance risk and reward and do not take unwarranted risk in an attempt to beat the market.

Since 1963, we’ve been helping clients construct well-diversified portfolios of high-quality investments and providing competitive returns. And, as a fee-only fiduciary investment manager, we do not accept commissions of any kind. It's about making smart, straightforward investment decisions to help clients achieve their financial goals.

Reach your goals confidently

Our approach to investing is based on a balance between risk and reward. We primarily use broadly diversified investment portfolios which capture both equity and fixed-income market returns, domestically and internationally, and add other investment vehicles to reduce portfolio volatility and increase expected returns over time.

This balanced approach helps reduce ups and downs in your portfolio and potentially increase your returns over time. Plus, we have access to some of the lowest cost investment tools available, which helps to increase net returns without additional risk. It's all about finding the right mix of investments to help you reach your goals confidently.

Contact Us

Bill Ryan

VP, Investment Officer

No commissions

As a fee-only fiduciary investment manager, we don't accept any commissions, so our decisions aren't swayed by the possibility of transactional compensation. Our fee is based on the market value of your account, so if it goes down, our fee goes down too. This means our financial interests are in alignment with yours.

Michelle Gordon

CFP, Investment Officer

Trusted professionals, attentive local service

We’re different from the big firms, able to provide professional guidance in estate planning and trust administration, along with a caring and compassionate nature. Whether you’re looking for a trustee of your own trust or you’re a beneficiary of a trust, Exchange Bank professionals personally administer trusts for a variety of reasons:

- To provide benefits for surviving spouses

- To manage assets for children or grandchildren who are too young to receive an inheritance

- To protect adult children who engage in self-destructive behaviors

- To provide for individuals with special needs who may lose government assistance if they receive an inheritance

- To ensure that non-profit organizations’ important causes are funded for years into the future

By combining trust administration with investment management, our trustee services are often more cost-effective than those which take an unbundled approach.